- Call Today: (904) 438-8082 Tap Here to Call Us

How Military Pensions Are Divided in a Florida Divorce

Introduction

Divorcing military service members or their spouses in Florida face unique challenges when it comes to dividing assets, particularly military pensions. Unlike civilian retirement accounts, military pensions are governed by both state and federal laws, including the Uniformed Services Former Spouses’ Protection Act (USFSPA). These laws determine how much of a military pension, if any, a former spouse is entitled to receive.

This guide explains how military pensions are treated in Florida divorces, what factors influence their division, and how spouses can protect their financial interests when negotiating a settlement.

Are Military Pensions Considered Marital Property in Florida?

Yes, military pensions are considered marital property under Florida’s equitable distribution laws. This means that the portion of the pension earned during the marriage is subject to division, while any portion earned before or after the marriage remains separate property.

However, military pension division is not automatic—Florida courts consider several factors before awarding a portion to a non-military spouse.

How Military Pensions Are Divided in a Divorce

The 10/10 Rule: Direct Payments from DFAS

The 10/10 rule is a federal guideline that determines whether a former spouse can receive direct payments from the Defense Finance and Accounting Service (DFAS):

- The couple must have been married for at least 10 years.

- The service member must have served at least 10 years of creditable military service during the marriage.

If the marriage does not meet this threshold, the former spouse may still receive a share of the pension, but the payments must come directly from the service member rather than DFAS.

Equitable Distribution in Florida

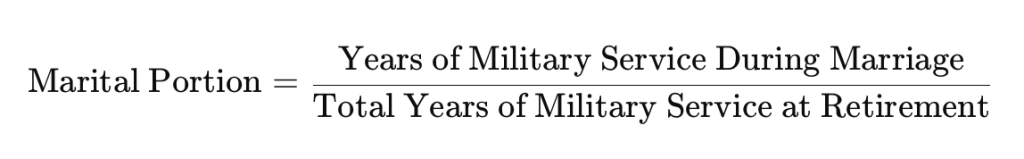

Even if a marriage does not qualify under the 10/10 rule, Florida courts still divide the pension using equitable distribution principles. The court applies a coverture fraction to determine the marital portion:

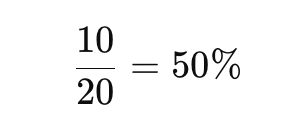

For example, if a service member served for 20 years, but was married for 10 of those years, the marital portion is:

If the court awards half of the marital portion to the former spouse, they would receive 25% of the total pension (half of the 50% marital portion).

Key Factors Courts Consider When Dividing Military Pensions

When determining how to divide a military pension, Florida courts may consider:

- The length of the marriage and its overlap with military service.

- Each spouse’s financial situation and future earning potential.

- Whether the non-military spouse sacrificed career opportunities to support the service member’s career.

- Any other retirement assets awarded in the divorce settlement.

Florida courts do not automatically award military pension benefits to a former spouse, so strong legal arguments may be necessary to justify a claim.

Other Military Benefits That May Be Affected by Divorce

Survivor Benefit Plan (SBP)

The Survivor Benefit Plan (SBP) allows military retirees to provide a portion of their pension to a former spouse after their death. If an SBP election is not made during the divorce process, the former spouse may lose the right to claim benefits after the service member’s passing.

Courts can order SBP coverage as part of the divorce settlement, but the former spouse must ensure proper enrollment is completed with DFAS within one year of the divorce decree.

Thrift Savings Plan (TSP)

The Thrift Savings Plan (TSP) is similar to a civilian 401(k) and is subject to equitable distribution in divorce. Unlike pensions, TSP funds can be divided immediately, either through a rollover or by awarding a percentage to each spouse.

VA Disability Benefits

VA disability benefits are not considered marital property and cannot be divided in a divorce. However, if a service member waives military pension payments to receive VA disability compensation, it may affect the amount of pension awarded to the former spouse. Courts may adjust alimony or other financial awards to account for this reduction.

How to Protect Your Financial Interests in a Military Divorce

If you are facing a military divorce, consider these steps to protect your financial future:

- Gather military service records – Obtain copies of retirement benefit statements and DFAS records.

- Determine eligibility for pension division – Use the coverture fraction to estimate the marital portion.

- Consider SBP enrollment – If you are the non-military spouse, ensure SBP coverage is addressed in the settlement.

- Negotiate offsets – Instead of dividing the pension, consider negotiating other assets in exchange.

- Work with an attorney experienced in military divorces – Military pension division follows unique laws, and mistakes can result in lost benefits.

How a Family Law Attorney Can Help

A family law attorney experienced in military divorce can assist with:

- Determining the marital portion of a military pension using the coverture fraction.

- Filing the necessary DFAS forms to ensure pension payments are properly allocated.

- Negotiating fair settlement terms that protect both spouses’ financial interests.

- Ensuring proper Survivor Benefit Plan enrollment to safeguard future benefits.

At Bonderud Law, we help military families navigate complex divorce issues, ensuring fair and legally sound financial settlements. If you need assistance with military pension division in your divorce, contact us today for a free consultation.

Conclusion

Military pensions are valuable assets in a Florida divorce and require careful consideration to ensure fair division. While the 10/10 rule determines whether payments come directly from DFAS, Florida courts still use equitable distribution principles to divide military pensions when applicable. Understanding how pensions, SBP coverage, and VA benefits are handled is essential for both military service members and their spouses.

If you are facing a military divorce and need guidance on pension division, financial settlements, or benefit protection, consulting with an experienced family law attorney can help you secure the best possible outcome.